Not known Details About Vancouver Tax Accounting Company

Rumored Buzz on Tax Accountant In Vancouver, Bc

Table of ContentsNot known Details About Tax Consultant Vancouver Not known Factual Statements About Virtual Cfo In Vancouver The Definitive Guide to Pivot Advantage Accounting And Advisory Inc. In Vancouver10 Simple Techniques For Tax Accountant In Vancouver, Bc

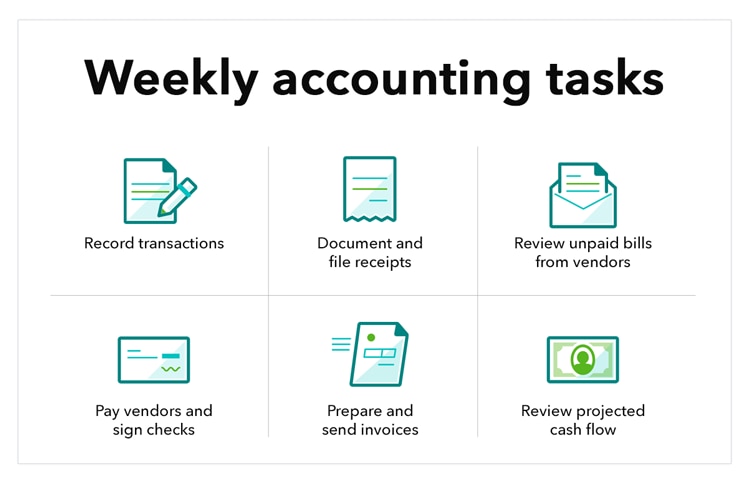

Not only will keeping cool documents and documents help you do your task more effectively and precisely, yet it will certainly additionally send a message to your company and clients that they can trust you to capably handle their financial details with regard and integrity. Being mindful of the many tasks you have on your plate, knowing the target date for each and every, as well as prioritizing your time accordingly will make you a significant possession to your company.

Whether you keep a detailed schedule, set up regular suggestions on your phone, or have a daily to-do checklist, stay in charge of your schedule. Even if you prefer to hide out with the numbers, there's no getting around the fact that you will be called for to communicate in a variety of methods with coworkers, supervisors, customers, and industry experts.

Also sending out well-crafted e-mails is an essential skill. If this is not your forte, it might be well worth your time as well as effort to get some training to enhance your value to a prospective employer. The audit field is one that experiences routine adjustment, whether it remain in policies, tax codes, software, or ideal methods.

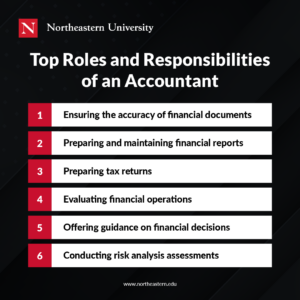

You'll discover crucial thinking skills to aid figure out the lasting objectives of a company (and develop strategies to accomplish them). Read on to discover what you'll be able do with a bookkeeping degree.

The smart Trick of Outsourced Cfo Services That Nobody is Discussing

Just how a lot do accountants and accounting professionals charge for their solutions? How a lot do accountants and also accounting professionals charge for their solutions?

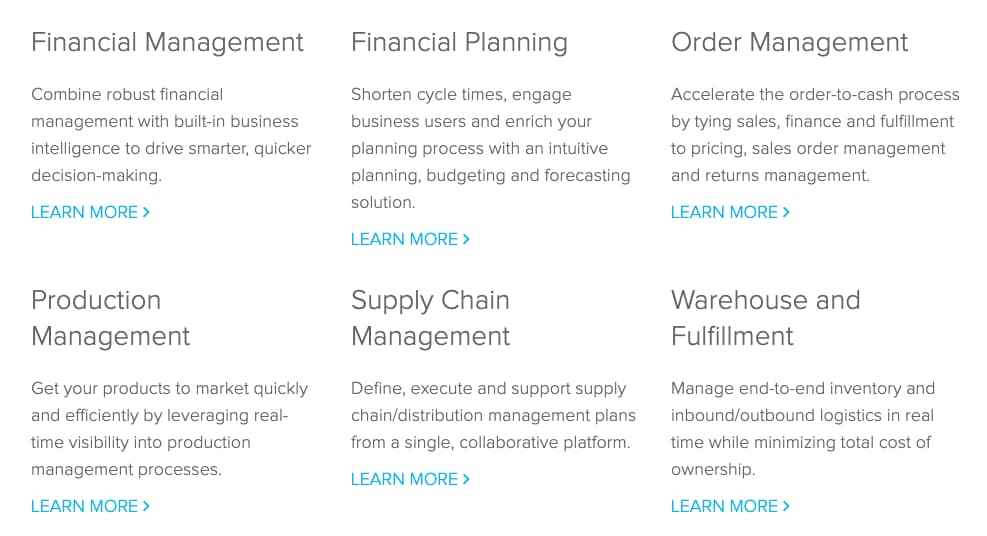

To comprehend pricing, it's practical to understand the difference in between accounting and audit. These two terms are frequently made use of reciprocally, yet there is a substantial distinction between bookkeeping as well as audit services. We have composed in information about, yet the very standard function of an accountant is to tape the transactions of an organization in a consistent way.

Under the typical technique, you will not recognize the amount of your costs till the job is full and the provider has actually accumulated every one of the mins spent dealing with your file. Although this is an usual prices approach, we find a pair of things incorrect with it: - It creates a scenario where customers really feel that they shouldn't ask concerns or pick up from their accountants and accounting professionals because they will certainly get on the clock as quickly as the phone is responded to.

Excitement About Virtual Cfo In Vancouver

Simply use the coupon code to get 25% off on checkout. Plus there is a. If you're not pleased after completing the course, simply get to out as well as we'll provide a full reimbursement with no inquiries asked. Since we have actually described why we don't like the standard design, allow's check out how we price our solutions at Avalon.

we can be available to assist with bookkeeping and also accounting inquiries throughout the year. - we prepare your year-end economic declarations as well as tax return (Vancouver accounting firm). - we're here to assist with concerns as well as support as needed Systems configuration as well as individually accounting training - Annual year-end tax filings - Support with concerns as required - We see a lot of small companies that have annual income in between $200k and also $350k, that have 1 or 2 workers as well as are proprietor handled.

Strong monthly coverage that includes insight from an outdoors consultant is a crucial success factor below. - we established your cloud audit system as well as show you just how to send papers electronically as well as see records. - we cover the expense of the accountancy software program. - we videotape month-to-month purchases as well as send valuable economic reports once per month.

Virtual Cfo In Vancouver - The Facts

We're additionally readily available to address inquiries as they come up. $1,500 for audit and also pay-roll systems arrangement (single price)From $800 each month (includes software program costs as well as year-end costs billed month-to-month) As services grow, there is frequently an in-between size where they are not yet large sufficient to have their very own interior financing department yet are made complex sufficient that just check my blog employing an accountant on Craigslist won't cut it.